st louis county personal property tax receipt

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Monday - Friday 8 AM - 5 PM.

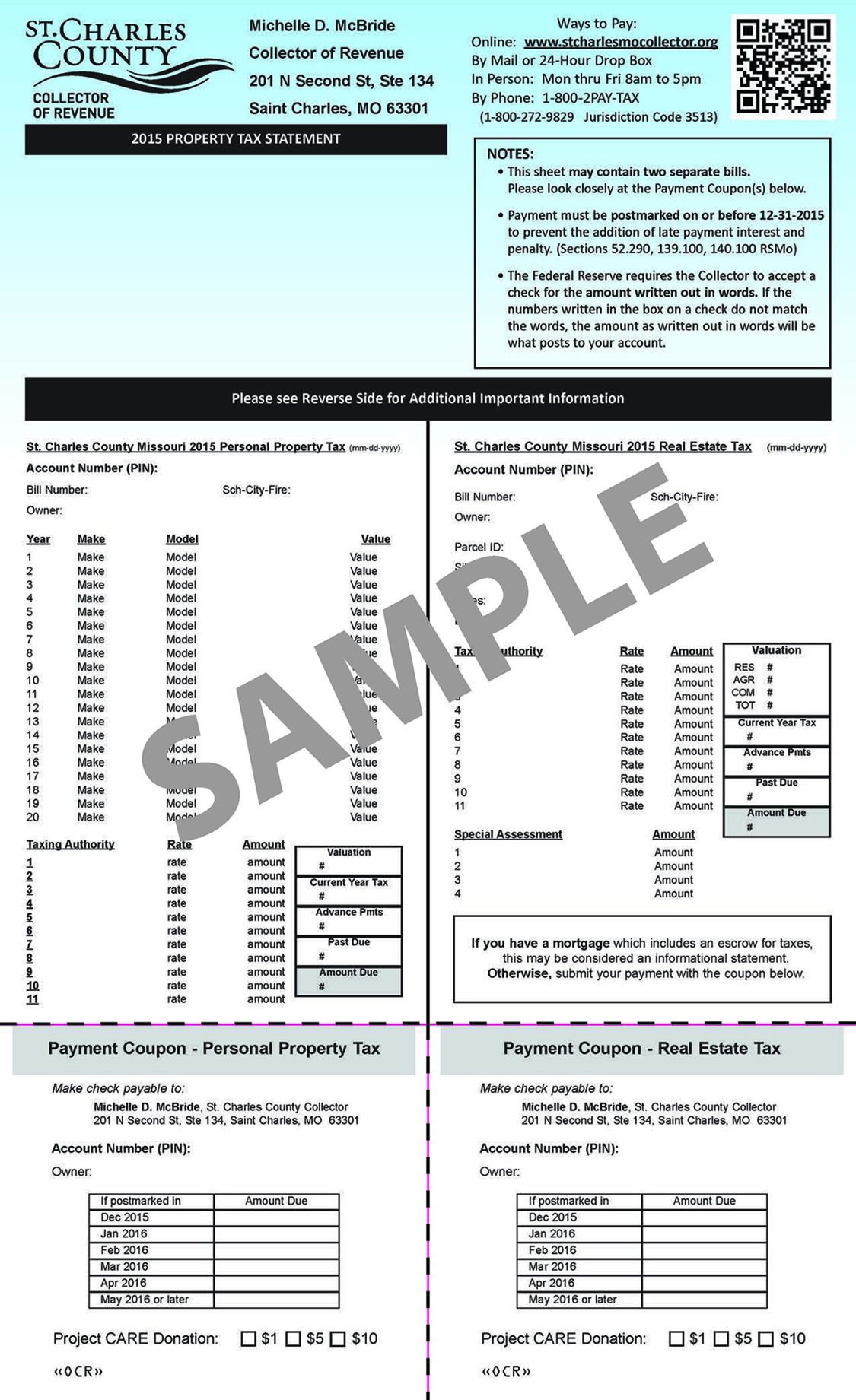

Personal Property St Charles County Mo Official Website

Use your account number and access code located on your assessment form and follow the prompts.

. Get Record Information From 2022 About Any City Property. Monday - Friday 8 AM - 500 PM NW Crossings South County. Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms.

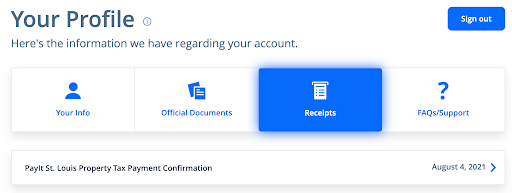

Taxes paid in the last three years will have a Print Receipt button on the right hand side. Louis County Circuit Court 7900 Carondelet in Clayton Monday through Friday 800 am to 500 pm. Louis County County Records Instantly.

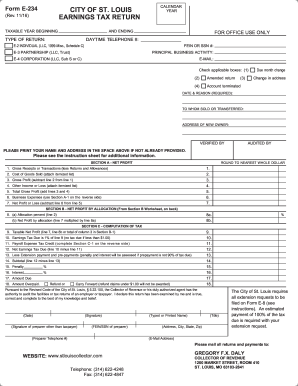

How do I pay my personal property tax in St Louis County. Monday - Friday 800am - 500pm. Louis City in which the property is located and taxes paid.

For prior years contact the. October 17th - 2nd Half Real Estate and Personal Property Taxes are due. City Hall Room 109.

1 Enter Any Name 2 Hit Search 3 Get County Public Records Online. Louis real estate tax payment history print a tax receipt andor proceed to payment. November through December 31st you may also drop off.

Property Tax Receipts are obtained from the county Collector or City Collector if you live in St. Personal Property Tax Department. You may also pay your taxes by mail.

Account Number number 700280. E-File Your 2022 Personal Property Assessment. Monday - Friday 8AM - 430PM.

Account Number or Address. You may file a Small Claims case in the St. Ad 1 Enter Any Name To Search 2 Get St.

Obtain a Tax Waiver. Assessments are due March 1. For information call 314-615-8091.

No Records No Fee. 41 South Central Avenue Clayton MO 63105. Send your payments to.

41 South Central Clayton MO 63105. Louis County Online Property Taxes Info From 2022. Obtaining a property tax receipt.

To declare your personal property declare online by April 1st or download the printable forms. Payments can be made in person at 1200 Market Street Room 109. May 16th - 1st Half Real Estate and Personal Property Taxes are due.

Monday - Friday 800am -. Washington County Property Tax Inquiry. August 31st - 1st Half Manufactured Home.

Mail a request stating the account numbers and tax years for which Duplicate Receipts isare requested along with a check or money order for the total number of receipts requested. Search the Real Estate Tax Lookup And Print Receipt application. Collector - Real Estate Tax Department.

Obtain a Real Estate Tax Receipt Instructions for how to find City of St. 1200 Market Street City Hall Room 109.

Real Estate Tax General Information

Clay County Missouri Tax A Resource Provided By The Collector And Assessor Of Clay County Missouri

St Louis Mo City Earnings Tax Form Fill Out And Sign Printable Pdf Template Signnow

St Louis County Did You Know You Can Print Personal Property And Real Estate Tax Receipts From The County S Website Just Find The Icon On The Homepage Of The Website As

Clay County Missouri Tax A Resource Provided By The Collector And Assessor Of Clay County Missouri

St Louis County Missouri Real Property Records Nar Media Kit

Missouri Receipt Fill Out Sign Online Dochub

Patti Waggin Pink Print Shop Receipt St Louis Mo For Business Cards 1958 Ebay

Sheriff St Louis County Courts 21st Judicial Circuit

St Louis County Directs Residents To Go Online For Property Tax Receipts

County Launches New App For Property Tax Payments Local News Emissourian Com

How To Find A St Louis City Personal Property Tax Receipt Online Payitst Louis

Property Tax Webster Groves Mo Official Website

/cloudfront-us-east-1.images.arcpublishing.com/gray/WLN7LZQM4JDHNHVSLENCA3HJ4Q.png)

Greene County S Personal Property Tax Mailed Out Paper Statements Coming Out Later Than Normal But Online Statements And Pay Are Available